Prospecting – identifying prospects for your email outreach – starts with defining your ideal customer profile.

The shared characteristics captured in your ICP can guide you to specific tools you can use to identify recipients at scale.

How broad or narrow you make your ICP directly impacts your email outreach. A broad ICP translates to a wider total addressable market (TAM) and more prospects that you’ll be able to find. A narrow ICP means you’ll know more about the prospects on your mailing list, so you'll target their needs directly.

In this article, I’ll cover:

- Trenching – striking a balance between width and depth in prospecting,

- Using market segmentation to create multiple narrow ICP segments.

Broad prospecting vs. deep prospecting

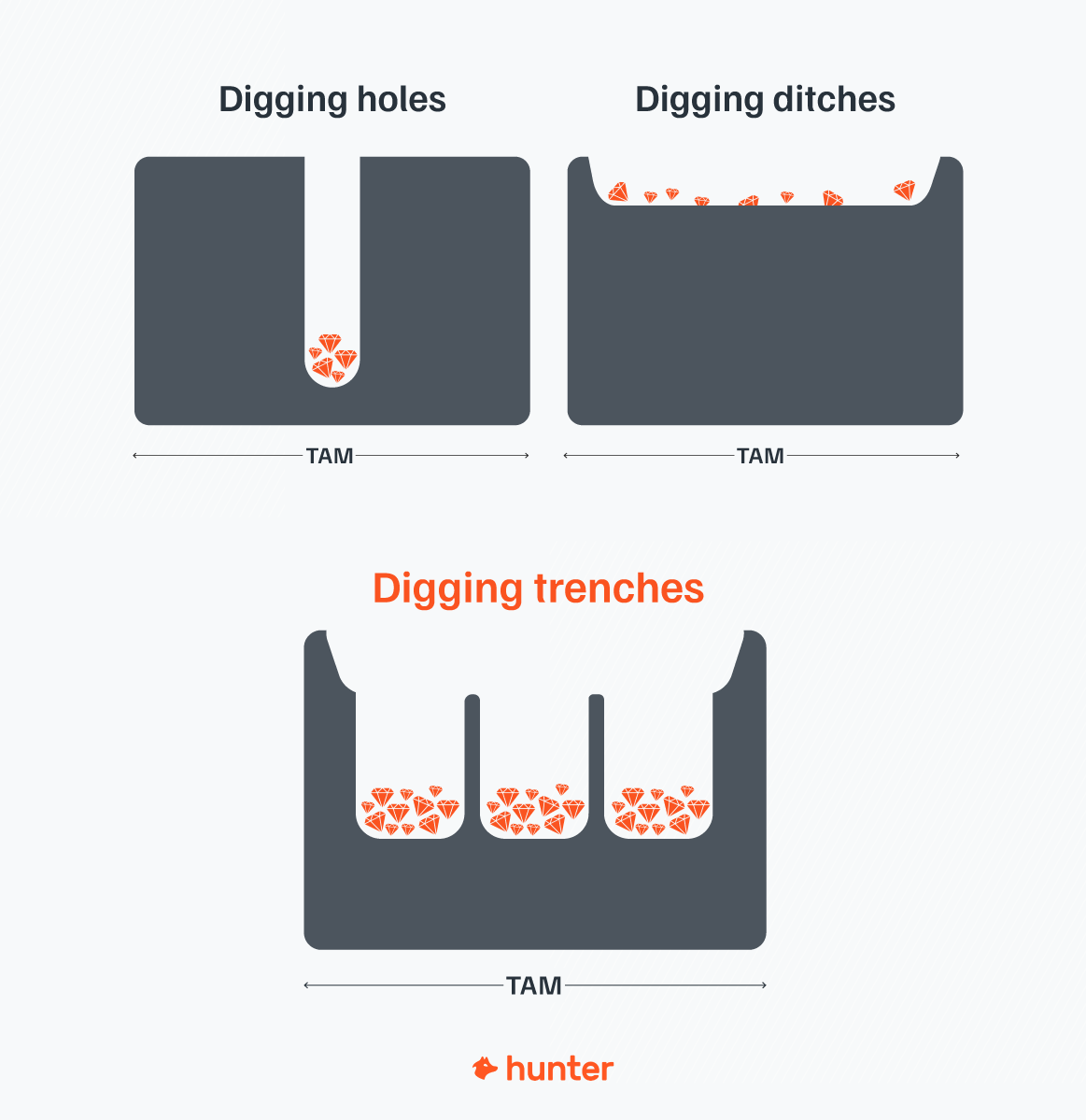

Imagine your prospects are diamonds. When you're prospecting, your job is to find them.

You can dig deep or dig wide.

Searching wide, you’ll find more prospects faster, but you won’t know exactly where you found them.

Searching deep, you’ll need more time to find the same number of prospects, but you know exactly where you found them.

The method you’ll use depends on how specific your ICP is:

- If it’s broad, you’ll be digging wide,

- If it’s narrow, you’ll be digging deep.

Digging wide (one wide ICP)

If you cast a wide net with a more generic ICP, you can target more recipients and scale your outreach.

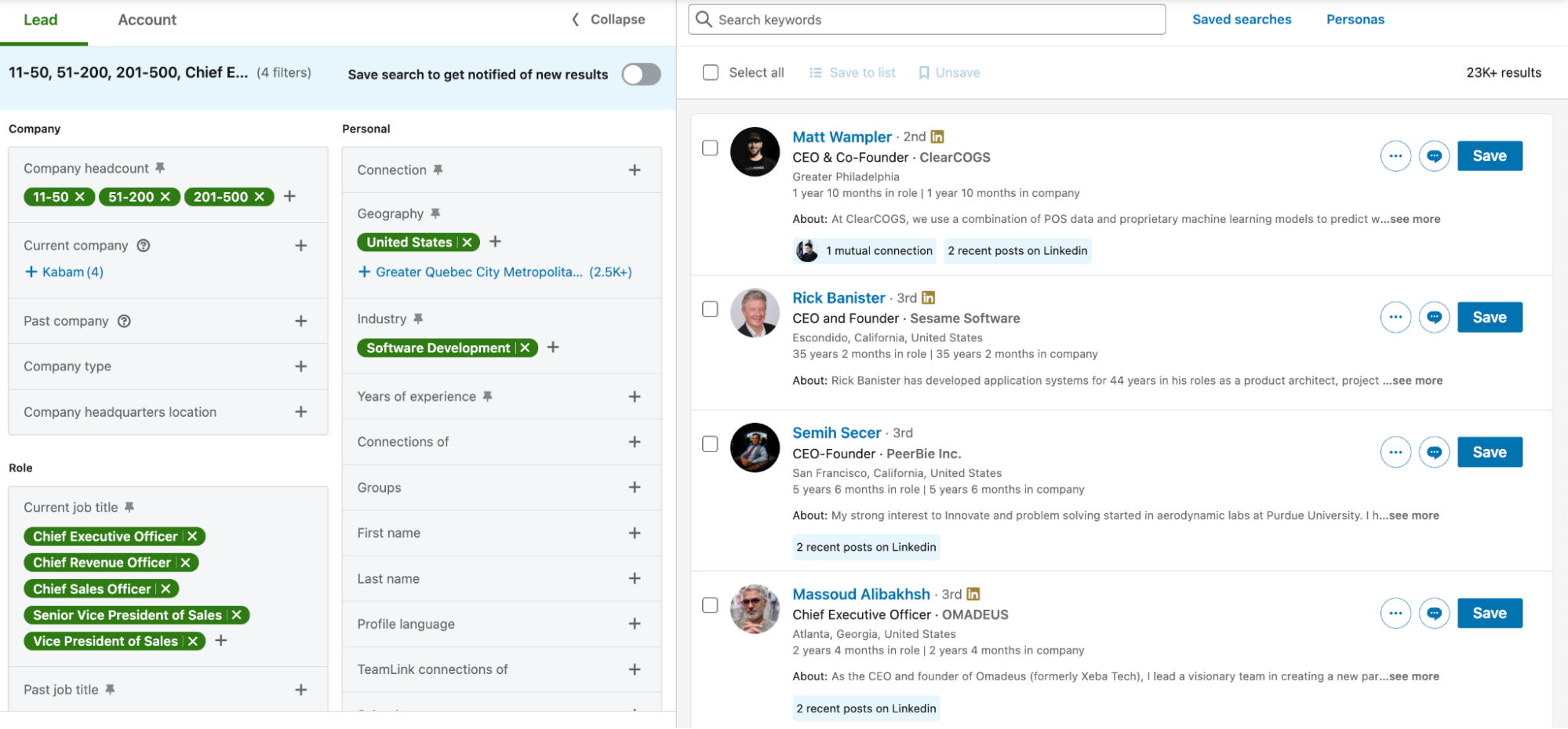

Example of a wide ICP:

- Job title: Senior VP of Sales, Chief Sales Officer, VP of Sales

- Industry: Technology

- Employee count: 11-300

- Location: USA

Pros:

- Easier to scale: A wider ICP means finding a given number of prospects will take less effort.

Cons:

- Harder to convert: With a broad group of recipients, you know less about each individual recipient, so you’ll have less confidence about their pain points and aspirations (see email below – it's clearly sent to a wide ICP.)

- Difficult to implement: You’ll need to send more emails to get the same results, which means setting up (and warming up) more domains and inboxes.

Digging deep (one deep ICP)

Using a narrow ICP, you can send a hyper-targeted campaign to a small group of recipients.

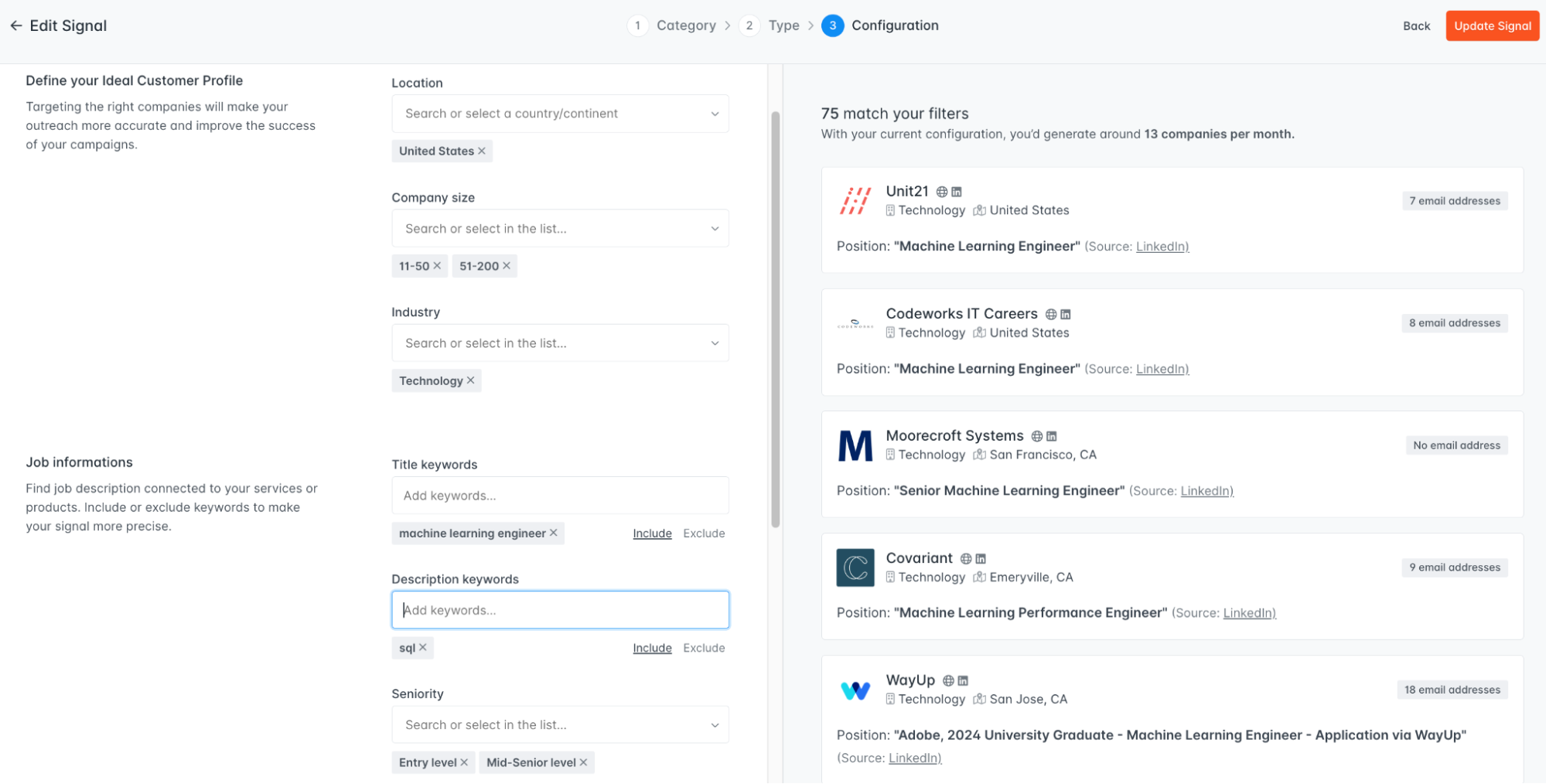

Example of a deep (narrow) ICP:

- Job title: SVP of Sales, Chief Sales Officer, VP of Sales

- Seniority: Entry level, Mid-Senior level

- Industry: Technology

- Employee count: 11-200

- Company recently posted job offers for: Machine Learning Engineer

- Job offer keywords: SQL

- Location: USA

Pros:

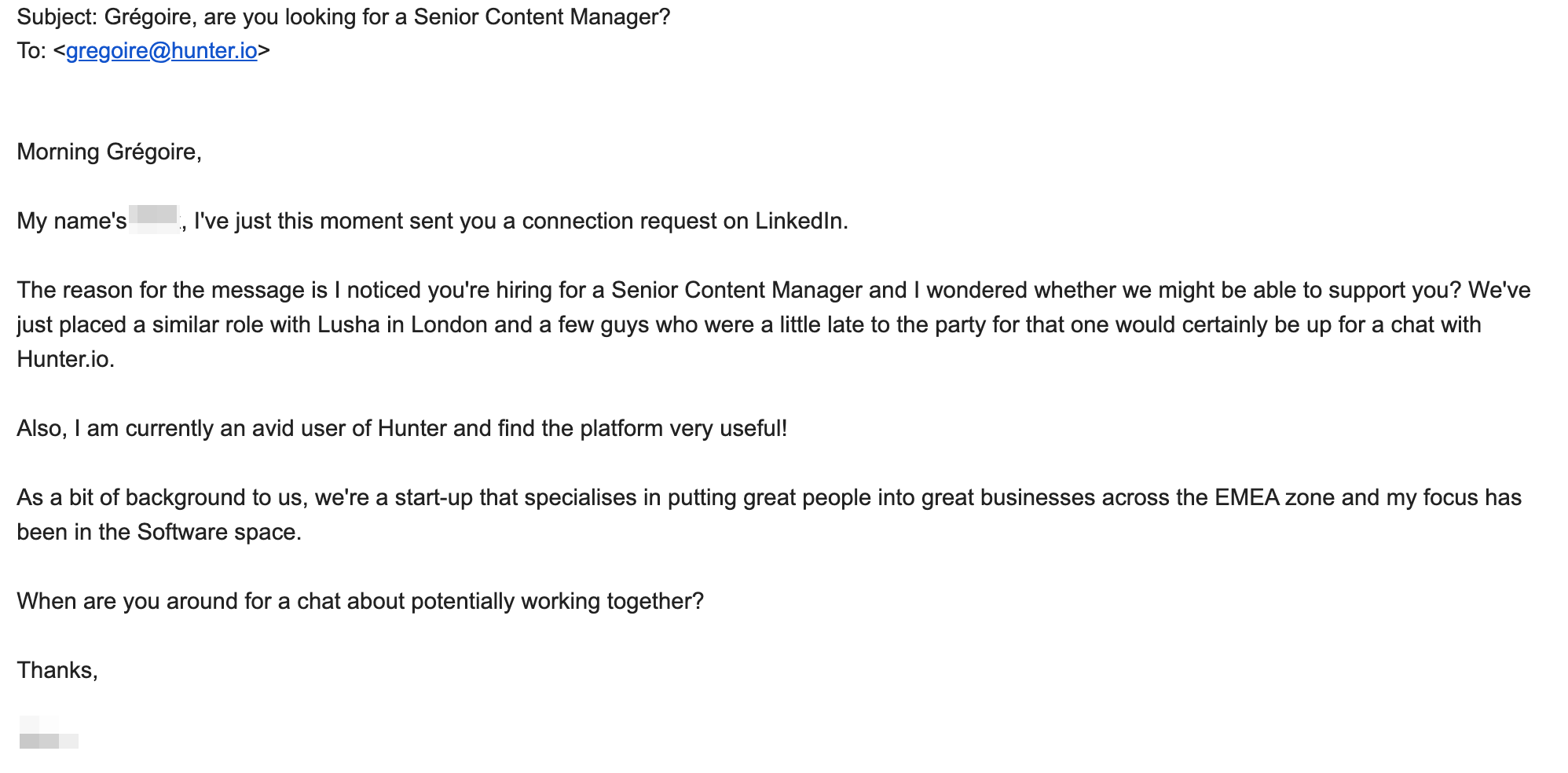

- Easier to convert: You’ll know more about your recipients, which means tapping into their specific problems and needs will be easier. This can positively impact your success rate (see email below.)

- Easier on the technical side: If you have fewer people to send emails to, you have fewer emails to send overall. You won’t need as many domains and inboxes to scale your daily sending volume.

Cons:

- More effort to find recipients: With a narrow ICP, you may need more advanced techniques to find qualified prospects.

- Less scalable: The total market captured by your narrow ICP will simply be smaller.

Trenching (multiple deep ICPs)

There’s a third approach, which I call trenching. Instead of digging a shallow ditch or a deep hole, you dig a trench by digging multiple holes next to each other.

This means using a wide ICP but segmenting it using market segmentation variables. This approach helps you more fully cover your total addressable market while retaining the benefits of narrow targeting.

Trenching is time-consuming but guarantees better ROI. If you're serious about email outreach as email providers increasingly crack down on bulk senders, I believe trenching is the only way forward.

Here’s why trenching is the best approach to finding prospects:

- Safety: Email providers have increasingly cracked down on cold email practitioners: Zoho, an email provider that used to be especially popular with cold emailers, started banning users for sending bulk emails in 2023, and Gmail recently announced more rigid requirements for bulk senders. Using trenching, you’ll send multiple smaller over a longer period of time, so you’ll be sending fewer emails daily, and they will be hyper-relevant, lowering your spam complaint rate.

- Personalization: You need your cold email to stand out from the crowd in your recipient’s inbox. This is much easier using narrow ICPs because as your prospects are more defined, you know more about them from the start. It allows for more natural personalization.

- Relevance: Contacting more recipients with a single motion means it will be harder to make your emails relevant. It’s safe to say that with a narrow ICP, you won’t be sending spam – your cold emails will speak directly to the situation of your prospects.

- Coverage: Finally, remember that using a narrow ICP doesn’t necessarily limit your total addressable market (TAM.) You can find a similar number of prospects using multiple narrow ICPs instead of a single, wide ICP – but it will take more effort.

How to create ICP segments using market segmentation

The best way to start creating multiple ICP segments is to use market segmentation.

1. Start with the Value Proposition Canvas

The best starting point is to use the Value Proposition Canvas and define the key jobs to be done (JTBD) of your ideal customers and their associated pains and gains. Other shared traits may be important, but jobs to be done are at the core of who you’re looking for.

2. Segment your ICP using market segmentation variables

With your broad customer profile outlined, review the market segmentation variables and consider which criteria you could use to segment your total addressable market.

Then, create segmented ICPs by adding market segmentation variables to your Value Proposition Canvas customer profile.

There are several types of segmentation that you can use. I always review all variables and try to answer all questions to surface as many ICP segments as possible.

Below, I’ll present common segmentation variables and create a customer segment, gradually enriching it with additional attributes.

Professional demographic segmentation

Professional demographics focus on the attributes related to people’s professional capacity. Demographic data answer the following questions about your prospects:

- What industry do they work in or used to work in?

- What are their current and past job titles?

- How senior are they (intern to C-level)?

- What’s their education level and training?

- Where are they currently located?

- What are their professional connections? Do you share any common connections with them?

My prospect:

1. Wants to drive local brand awareness for a new product line, and

2. Is a VP of Marketing, and

3. Is based in the UK.

Firmographic segmentation

Firmographics focus on the attributes of companies. In the context of prospecting, you want to answer questions about your prospects’ companies:

- How many people work there?

- What are the teams in the company?

- Are there any past employees you might mention or leverage in your campaign?

- What industries does the company serve?

- How long has the company been in business?

- How many locations does it have?

- Where does the company operate, and under what legal jurisdictions?

- Who owns the company, and what is the ownership structure?

- What’s the financial situation?

My prospect:

1. Wants to drive local brand awareness for a new product line, and

2. Is a VP of Marketing, and

3. Is based in the UK, and

4. Works at an enterprise company (5000+ employees), and

5. The company has 20+ physical locations.

Technographic segmentation

Technographics refer to the technologies used by people and companies.

- What hardware is the company using?

- What types of software are they using in their work?

- Which technologies are used on the website? (e.g., content delivery networks, cybersecurity, frontend, backend, and more)

- Which social media platforms is the company using?

- Which technologies is the company using in its product? (e.g., AI)

Leveraging technographics takes a deeper understanding of each tool in the prospect’s stack. On a surface level, you may be able to use technographics to find companies that are using a competing solution. But on a deeper level, technographic data can tell you about the needs and priorities of any company. For example, if you know a given company is using Heap, Amplitude, and Adobe Analytics on top of the ubiquitous Google Analytics, then you know it’s a company that heavily emphasizes traffic analytics, and it should tell you a lot about its marketing priorities.

My prospect:

1. Wants to drive local brand awareness for a new product line, and

2. Is a VP of Marketing, and

3. Is based in the UK, and

4. Works at an enterprise company (5000+ employees), and

5. The company has 20+ physical locations, and

6. The company is using Facebook Pixel on the website and runs Google Ads campaigns.

Situational/behavioral segmentation

Situational or behavioral segmentation is usually the trickiest to perform because it relies on data types that are often changing and difficult to capture.

Funding:

- Has the prospect’s company recently got any funding?

- What’s the financial structure of the company: is it bootstrapped or is it using external funding?

- Who are the current investors?

- Is the company planning another funding round?

Mergers and acquisitions:

- Was the company recently acquired or merged?

- Has it acquired a different company?

Company job postings:

- Has the company been hiring in the recent past?

- What types of positions has the company hired for?

- What skills is it looking for in its future employees?

- What do the job postings tell you about the company's needs, including its tech stack, financials, and growth stage?

- Is your prospect the recruiting manager in any ongoing hiring process?

Prospect-related:

- Has the prospect recently switched jobs?

- Has the prospect attended any professional events recently (webinars, conferences, meetups), or are they planning to attend any in the future?

- Who is the prospect engaging with on social media?

- What is the prospect talking about on social media?

Products and services of the company:

- Has the company recently launched any new products, features, or services?

- How do the customers rate their products and services?

Competitors:

- Who are the main competitors of the prospect’s company?

- How do the customers rate the products and services of their competitors?

Other:

- Are there any new legal requirements for the prospect or their company?

- Do any company members follow you or interact with you on social media?

My prospect:

1. Wants to drive local brand awareness for a new product line, and

2. Is a VP of Marketing, and

3. Is based in the UK, and

4. Works at an enterprise company (5000+ employees), and

5. The company has 20+ physical locations, and

6. The company is using Facebook Pixel on the website and runs Google Ads campaigns, and

7. Their competitors are running outdoor ads, and

8. They recently launched a new physical location, and

9. They have a job offer for a marketer with experience in outdoor advertising.

3. Iterate

I showed you how market segmentation can help you create a narrow ICP segment. But the trick with trenching is to keep iterating on your ICP, creating multiple narrow segments to cover as much of your total addressable market as possible.

Next steps

By now, you should have several narrow ICP segments defined and understand whether they are using demographic, firmographic, technographic, or behavioral segmentation.

With all this knowledge, figuring out the tools and methods you can use to find prospects will be much easier. That’s what we’ll cover next.