How to Calculate and Verify TAM, SAM, and SOM with Hunter

What is your market opportunity? How many customers are there in your space, and how many of them can you get to use your product? It’s a big question.

For founders, it's absolutely critical whether they are looking for funding or not. But it's also important for sales teams mapping and prioritizing markets to engage.

A look across Reddit, Quora, and LinkedIn shows that while people think calculating your Total Addressable Market (TAM) is important, getting real data for your answer is hard and expensive—and many turn to abstract estimates they don't trust themselves.

While TAM estimates are always identified through imperfect science, they do have to be defendable. Defendable to investors, co-founders, and your team. It is the logical leap from a market strategy to the reality of growing your business, getting new funding, or entering new markets.

So how do you estimate your Total Addressable Market without breaking the bank?

In this blog, we’re going to show you how to calculate your market’s size with Hunter’s TAM calculator, and why you don’t need to be a Gartner licence holder, SalesNavigator subscriber, or use an over-expensive, inaccurate market list to be confident in your strategy.

Market sizing 101: what is TAM, SAM, and SOM

Total Addressable Market (TAM) is not the only term you need to understand before coming up with a accurate, tangible assessment of the business opportunity in front of you.

We need to break down the difference between TAM, SAM, and SOM.

Beyond being a random collection of letters, these are different ways to classify the lenses through which you can assess your ability to deliver revenue from buyers.

TAM vs SAM vs SOM

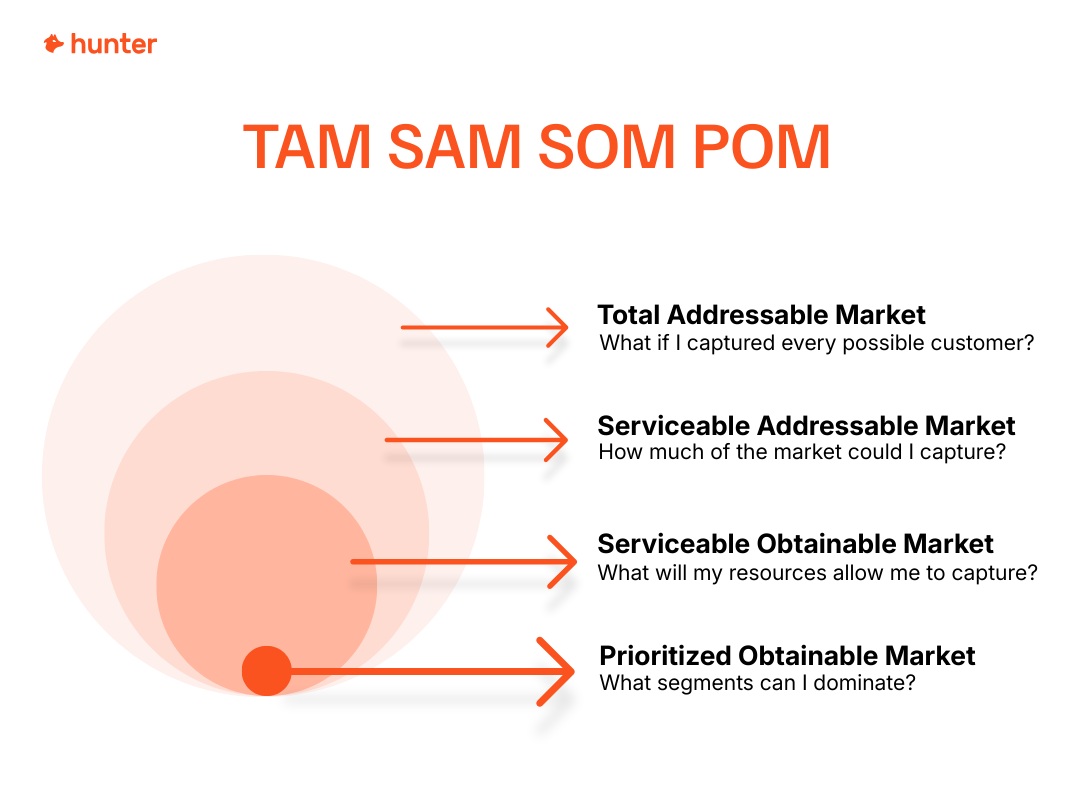

There are three different levels of looking at your market (and one bonus layer for those serious about leveraging market data to win new business in the most efficient and effective way):

- TAM (Total Addressable Market) looks at the total market without limitations.

- SAM (Serviceable Addressable Market) looks at a portion of the market you can win given limitations of your product or business model.

- SOM (Serviceable Obtainable Market) considers the portion of SAM that you estimate you'll be able to capture given resource, knowledge, and time constraints.

- POM (Prioritized Obtainable Market) looks at the segments within your SOM that you have the most likelihood to succeed and at scale within that segment.

Let’s dive deeper.

What is a Total Addressable Market?

In short, the Total Addressable Market (TAM) is the absolute market for your solution.

If you combine every competitor, consider all viable buyers, and remove all your resource constraints, this is exactly the dollar amount you will earn as the sole provider in this market.

Your TAM shapes your business goals, but it is not a realistic number of companies you market to. You need to make that market addressable by identifying factors that narrow it down.

To give an example, let's look at Linear.

Despite being targeted at a specific set of users (which we'll cover later), Linear belongs in the project management software category, like ClickUp, Asana, Trello, Jira, and the like.

Linear's TAM can then be calculated by multiplying the number of companies that might require project management software by average lifetime value.

What is a Servicable Addressable Market?

The Serviceable Addressable Market (or SAM) is the percentage of the TAM that you realistically can win.

This is often where founders skip the calculation and loudly proclaim their market size is $1b. But you need to make it realistic.

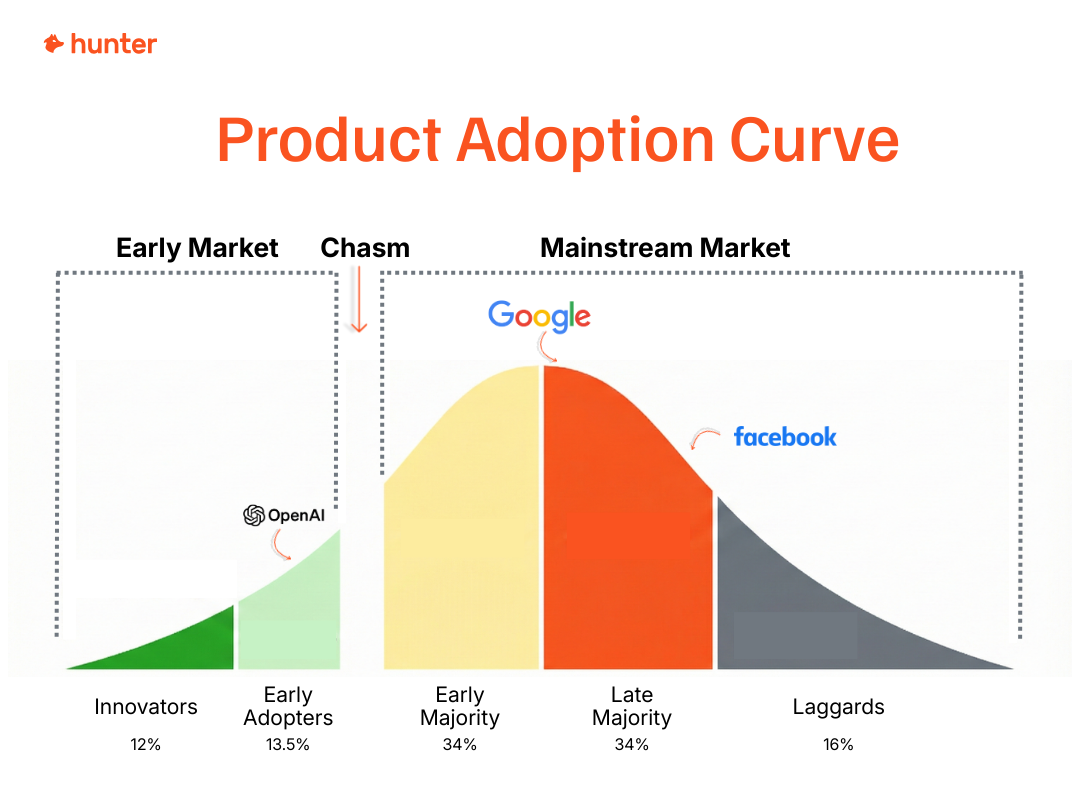

One way to find what is realistic is to understand where your market is on the product adoption curve.

This method, developed by Geoffrey Moore, is a means by which to say your market is at the beginning of its life (e.g., nascent AI companies), has reached mass adoption (Google), or is still being adopted, but by people later to the party (e.g. over 50s using Facebook).

If you know where the market sits on the adoption curve, you can re-scope your market size.

Alternatively, you can use industry, company size, funding, geography, or all of these.

To continue with the Linear example, Linear's platform doesn't aim to appeal to every single professional.

Instead, it's built for modern software development teams. This constraint limits the market opportunity, because Linear's competitors will likely penetrate market segments that Linear isn't built for.

But that’s still not enough. We need to know what’s obtainable.

What is a Servicable Obtainable Market?

The Serviceable Obtainable Market (or SOM) is a realistic figure of how much of the market you can penetrate. It is the number that will help inform your pricing, go-to-market strategy, sourcing materials and tools, and hiring.

What is often lost in the mix is the word “obtainable.” Yes, you could focus on financial service companies in the United Kingdom, but you’re going to be coming up against other business who are well established, have more resources, or experience in this area.

The difference between success stories, also-rans, and never-weres often lies here. The SOM acts as the genesis of your first wins and eventual ideal customer profiles - the businesses that you target with your go-to-market.

There are two ways to calculate SOM in dollars.

Firstly, you can make an estimate based on:

- Your experience in the market (i.e. you perform well in Birmingham, UK, and Manchester, UK)

- Your resources (i.e., budget and sales team) let you generate 1,000 leads a year, resulting in 50 sales.

Which means your SAM of $70,000,000 is lowered to $20,000,000 based on geography, and your close rate of 5% puts your SOM closer to $5,000,000.

Alternatively, you can use this calculation: how much of the market share you had last year, multipled by this year’s SAM.

In numbers:

Last year’s market share of 50% (= Last year’s revenue [$750,000] / last year’s SAM [$1,500,000]) x this year’s SAM of $5,000,000 = $2,500,000

That number will inform your marketing budget, sales goals, and conversion rates. It informs how you prioritize everything.

Continuing with our example, Linear seems to appeal to fast-moving, agile teams that are frustrated with the bloat of legacy solutions like Jira.

Another constraint on their market size is that it is primarily a self-serve solution, which may turn off enterprise prospects. Finally, Linear seems to be a lean team without an extensive sales capacity or the resources to heavily invest in multi-channel growth. All these factors would have to impact the SOM calculation, shrinking the SAM estimate.

What is a Prioritized Obtainable Market?

A Prioritized Obtainable Market (or POM) is where your market is so well defined that you can specialize in a specific segment of your SOM.

Few will go to this layer, but if you do, you can be laser-focused in your messaging to speak to the outcomes your solution delivers for a portion of the market.

Whereas SOM may contain many different segments of your ideal customer (known as an ideal customer profile,) POM encourages you to pick a highly specific market that you think will be easiest to penetrate.

This methodology encourages prioritizing your targeting and resource allocation to “build deep” within a segment.

It is a method that allows you to become the authority to one audience and, using Moore’s network effect approach, move into adjacent segments where you are more likely to win, because those POMs trust the one you have succeeded in.

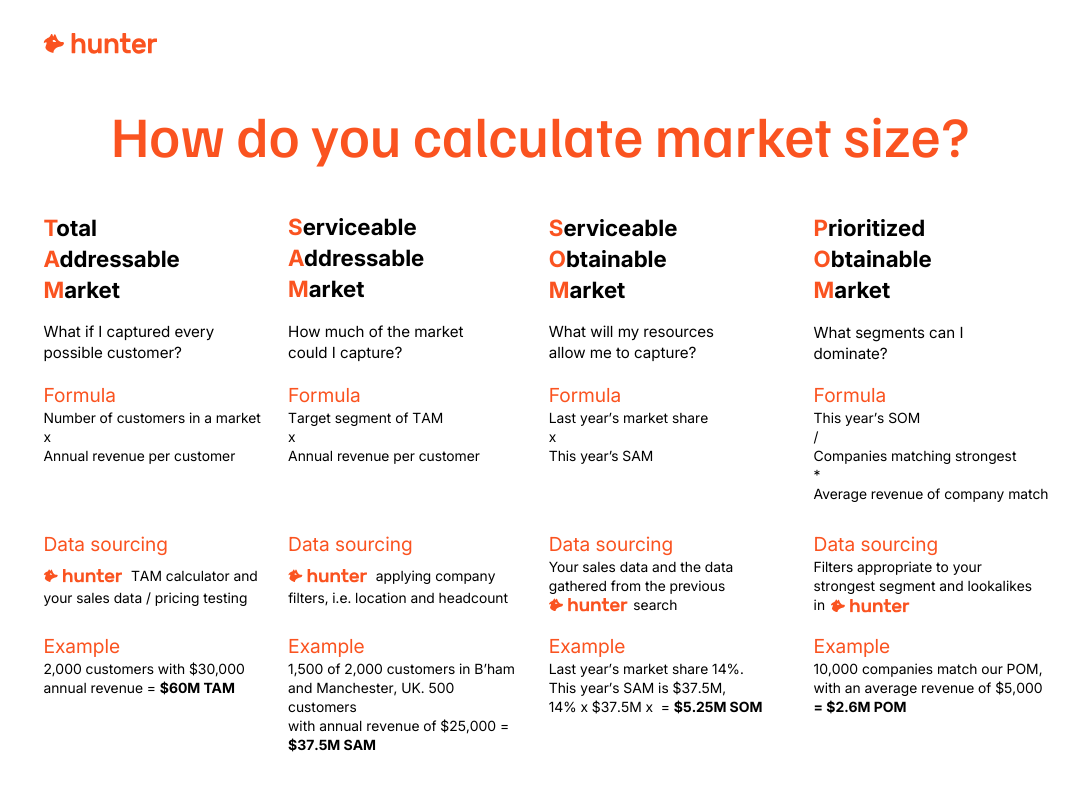

Example formulas for TAM, SAM, SOM, and POM sizing

Once you have your Hunter data, sales data, and other research, you have all the total addressable market calculation components needed to produce accurate numbers.

Here’s the math.

How to size up your market using Hunter’s TAM calculator

Hunter lets you browse a huge web-sourced B2B database for free.

By focusing only on companies with actual websites and tangible email addresses, you’re removing another layer of abstraction from your TAM estimate.

Here’s how to use our Total Addressable Market calculator:

Even better, you can easily make more specific plans related to your SOM by segmenting companies you find in Hunter: either in Discover or after saving them as Leads.

When should you calculate your TAM?

You need to revisit your TAM at least once a year. Calculating your TAM is not a one-and-done routine. However, the realities of gathering data (both in terms of access and cost) mean that few founders, product organizations, or salespeople revisit the numbers.

How to use TAM, SAM, SOM, and POM calculations

Calculating your TAM is one of several steps you can take to inform your planning, but don’t limit your use of a TAM calculator to supporting investment conversations. You should calculate TAM to support:

- Scoping new markets to enter (founders, product managers, product marketers, sales)

- Competitive intelligence (founders, product managers, product marketers)

- Sales territory mapping (sales and product marketers)

Putting real data behind your market sizing estimates lets you tell a compelling story—even if you’re only telling it to your team or yourself.

Using Hunter’s TAM calculator, you can put real names of companies and recipients behind your market sizing. To go a step further, you can verify how “obtainable” a given market segment is, and prioritize your focus using email outreach.

Use Hunter’s TAM calculator to get started on market sizing

Sizing your market no longer needs to be hidden behind Gartner, SalesNavigator, or paid lists.

With Hunter’s TAM calculator, you’ll access up-to-date, real-company numbers that give you the confidence to secure investment, generate business, and successfully enter new markets.

Imagine how convincing you’ll come across to investors if you say that you booked 10 interviews after reaching out to 100 contacts in your SAM, and now you have a POM.

Founders, you need not worry about using data you’re unsure about.

This TAM calculator is free to use, and with it in hand, you can go from pitching for investment to lead generation, all inside Hunter.

That’s a calculation you can rely on.

Send cold emails with Hunter

Send cold emails with Hunter